Tips From a Salesman on How to Buy a Car

Buying or leasing a new vehicle can be terribly stressful. This is understandable because cars and trucks are often the most expensive things people purchase after their homes.

Driving off the lot feeling like you’ve been taken advantage of is disquieting at best. You’re supposed to be riding high on a wave of endorphins after acquiring a new ride, not feel like you’ve been sent through the wringer to have every penny squeezed out of your savings. To help prevent this automotive anguish here are some car-buying tips to save aggravation, stress and probably a bit of money.

First Things First

As the old proverb goes, knowledge is power. Having some basic information handy BEFORE you walk onto the showroom floor can be extremely helpful, so do your homework.

Ric Lanning, a client advisor at University Ford and Kia in Durham, North Carolina suggests potential buyers go on the internet, but not just to window shop for cars. “A lot of the dealerships will have reviews on there,” he said. Find the stores with the best ratings and don’t be afraid to look for a highly recommended salesperson. Lanning said, “I think people need to buy from someone they trust.”

Additionally, stores with veteran salespeople that have been there for decades is often a good sign. Lanning said, “This tells me the dealership is fair.” Staff that’s well treated and makes a decent living tends to stick around.

So, you’ve found a place to shop and a good salesperson. Great! But your work isn’t finished. It’s also advisable to know what you’re looking for. Again, vehicle reviews and purchasing advice from websites like AutoGuide.com (there’s nothing wrong with a little shameless self promotion) can make your life appreciably easier. “Do your research and then there are no surprises,” said Lanning.

It’s important to compare standard features and fuel economy, pricing and safety ratings. “If all the crash dummies got killed then I wouldn’t go look at that car,” said Lanning with a chuckle. Still, you don’t always need to know exactly what you want before going to a dealer. Sales professionals should be educated in the products they’re offering.

Trust is also an important thing. “I know that’s hard for some people,” said Lanning, to have faith in a dealer. “I’m not stupid. I will help you if you allow me to.” Remember, he doesn’t get paid unless he closes the deal; it’s in his best interest to make you happy so you sign the dotted line.

Money Matters

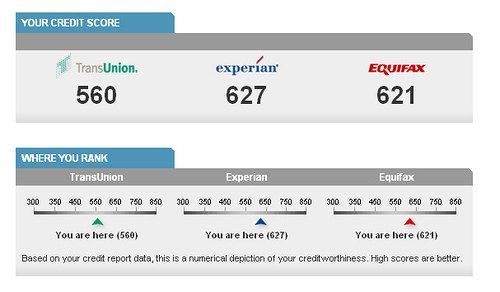

But there’s more to being an educated consumer than knowing where to shop and what kind of vehicles to look at. Josh Lewis, a former salesman at a Mazda/Kia store in North Carolina said people should know their credit scores before setting foot inside a dealership.

Lewis also said buyers should know what they’re able to spend. During his stint in sales he said people that could afford a $30,000 car would come in and try to haggle for a model costing 50 grand or more. Naturally this is a waste of time for both parties involved.

As a sale progresses Lewis said some other big things customers should ask about are interest fees and the financial institutions the dealer is shopping. Terms and rates car vary wildly. He also said, “I recommend people try to find out some information before they go into finance.” Shopping at your own bank or credit union is a no-brainer.

On the subject of money Lewis said, “Do not, DO NOT let anyone run your credit unless there’s a deal you want to do [that day].” This can be detrimental because, “Every time they open up your credit score they’re dinging [it a few points].” If you know what your rating is he said you can just tell them and spare any unnecessary damage to your score

Politeness Police

You catch more flies with honey than vinegar and you probably stand a good chance of getting a nice deal if you’re polite and honest with the salesperson. “Car salesmen get a bad rap and probably deservedly so,” Lanning said, adding that a lot of them are not straight with buyers. “Most of the crap about the car industry has been around for years … most people have heard the scary stories.”

But Lanning cautioned, “It’s all about attitude. I’d much rather be of assistance to someone that’s a little bit open to listen to my opinions than someone that’s going to come in and tell me how to do my job.” Figuratively speaking he said don’t show up with “your guns loaded” fixin’ for a fight.

Showing the salesperson that you’re not a complete dick or simply there to waste his time joyriding in cars can improve your odds of having an amicable relationship. “Once you establish that line of credibility they back down, you back down … It becomes less of ‘how I can take advantage’ and more of equals,” Lewis said.

Working the Deal

After you’ve decided on the vehicle that’s right for you it’s time to do a little haggling, probably the part of this process that people hate most. It may feel more awkward than a middle-school dance but why not give it a try? Offering some encouragement Lewis said, “If you can get it don’t be afraid to ask for it.”

On the other hand you shouldn’t expect a miracle. For example, Lanning said if a vehicle stickers for $40,000 and has an invoice price of $35,000 don’t expect to drive away in it for 25 grand. “That [sort of] conversation usually doesn’t go very far,” he said. Remember, “The dealer has to make a dollar to stay in business.” They typically don’t make a habit of giving vehicles away.

One potentially useful bargaining chip involves down payments. “The more you can squeeze for [one] the better,” said Lewis. Financial institutions like lots of cash up front and a big down payment can significantly lower your interest rate, saving you money in the long run.

“Don’t be afraid to talk about money,” said Lewis but he cautioned, “Don’t do it too soon.” People can sabotage a deal by becoming too assertive early in the process. Lewis also mentioned that if you’re overly guarded or inflexible there’s nothing for the dealer to work with, which can rapidly become “a waste of everybody’s time.”

SEE ALSO: What Does a VIN Do?

Now, let’s say you’ve found the perfect vehicle and determined how much you’re willing to pay for it. “If a customer has made an offer to me I’ve got to present it to management,” Lanning said. Sales representatives usually aren’t allowed to finalize deals. This is where the often-aggravating back and forth part of negotiation starts, with the salesperson serving as a liaison between the buyer and management. But have a little faith. “What the customer doesn’t understand is I’m on their side,” said Lanning, because once again his livelihood depends on closing deals.

Regarding this whole process Lewis said, “Don’t be afraid to chime in,” adding, “This is your money; this is what you’ve been working for. Don’t let somebody just play around with it.” Many dealerships will happily jerk your chain if you let them.

And if for whatever reason things don’t end up working out you shouldn’t immediately “blame the salesperson,” said Lewis. Often a failed deal is not their fault. The banks could have said no, you may not have been able to get a cosigner or even the manager could have shot things down. In a lot of cases the salesperson is just a messenger.

Fortunately when it comes to negotiations buyers have the biggest trump card of all. “Don’t be afraid to stand up and walk without any hesitation,” said Lewis, just make sure the dealer hasn’t permanently sequestered your keys and license following a test drive and/or used-car appraisal.

Making the Sale

After a deal is hammered out you’re not quite finished. You still have to take a trip through the financing office.

According to Lewis these guys “are trained to milk money” by getting customers to buy things like warranties, underbody rust-proofing or various protection packages, “things that are borderline against the law.” Showing his disdain for this part of the process he said, “It really is a black hole, a black hole of bull***t.”

SEE ALSO: What do do After a Crash

Some of the things offered by financing departments, which are really just another attempt to sell you stuff can be smart purchases, but never pay the price they offer. Lewis said, “My advice is, just have a plain face, a very poker face, laugh and joke with the person but when they offer something for $2,000 ask them why it can’t be $1,000.” One thing he does recommend is a good wheel and tire warranty, which can save you significant amounts of money down the road.

And remember, when you’re in the financing department and you’re unsure about something you can always say no. If you are compelled to purchase some extras Lewis strongly cautions that you “read the fine print carefully.”

Sealing the Deal

If you’ve done your homework, are shopping at a reputable dealership and have treated your salesperson with a modicum of respect there’s no reason why buying a car should be overwhelmingly stressful. “Don’t be scared of the process, it can be smooth,” said Lewis.

Seconding these comments Lanning noted, “People I think sometimes just make this process hard,” they “come in all stressed out.” But it doesn’t have to be that way. “I try to have a good time … I just try to make an enjoyable situation for people,” he said. And just think, when all of the research, haggling and paperwork is finished you get to drive home in a new vehicle, which is pretty exciting.

For more stories like this please visit our Tips and Advice Section.

Born and raised in metro Detroit, Craig was steeped in mechanics from childhood. He feels as much at home with a wrench or welding gun in his hand as he does behind the wheel or in front of a camera. Putting his Bachelor's Degree in Journalism to good use, he's always pumping out videos, reviews, and features for AutoGuide.com. When the workday is over, he can be found out driving his fully restored 1936 Ford V8 sedan. Craig has covered the automotive industry full time for more than 10 years and is a member of the Automotive Press Association (APA) and Midwest Automotive Media Association (MAMA).

More by Craig Cole

Comments

Join the conversation

I'm amazed at how many of yours think it's perfectly normal to buy a car on credit... In most of Europe you only buy a car that you can afford, if you can't afford a new one, you buy a used car. If you can't afford a used one, you buy a scooter. No wonder the US is so much in debt. And the most important tip is: Leave your number and don't be afraid to walk away if you feel you are being taken advantage of. They'll most likely call you back later with a better deal and even if they don't, other good deals will come on your path.

I'm amazed that there is not any mention of knowing about the various prices the car is sold for and the way to know what is fair! Not to mention knowing your credit options going in.