Should You Buy Back Your Leased Vehicle?

Auto leasing can sometimes seem like a glorified car rental, as you’re paying for a vehicle that doesn’t even end up under your name. However, a leased car can easily become yours if the price is right.

Leasing a car allows you to have monthly payments that are more affordable than financing a car, and gets you in a reliable, new vehicle that will be covered by warranty for the duration of your lease period.

SEE ALSO: Car Loans 101: What You Need to Know About Financing a Car

However, there are some restrictions to leasing a vehicle. You’re not allowed to exceed a number of miles during your lease term. And should you drive more than the allowable limit, you’ll be forced to pay for them upon the return of the vehicle – usually at an inflated price.

Additional charges can also be applied for nit-picky wear and tear on the vehicle, forcing you to pay for things like tire wear, the condition of a floor mat or other trivial items on the car.

THE BUYBACK

But if you want to play it extra smart, and maybe end up with a cheap ride, you can always buy back the lease car. Some companies are up front about how much money the car is losing over your lease term. If you subtract that value from the price of the car, then that’s your buy-back value. Other lease contracts may have that information presented to you when you sign the papers. Buying your leased vehicle is also a good way to avoid mileage penalties and other erroneous charges from the dealer.

BUYING A USED CAR – AT NEW CAR PRICES?

However, the extra cost may be worth it. Unlike other used cars, you know the full history of the car. Every door-ding, service-charge, road-trip and interior spill was with you in the car. Not only that, since the car was under a mileage allowance, it should have a relatively low odometer reading. You’re essentially buying the car from a very trustworthy and reliable first owner – you!

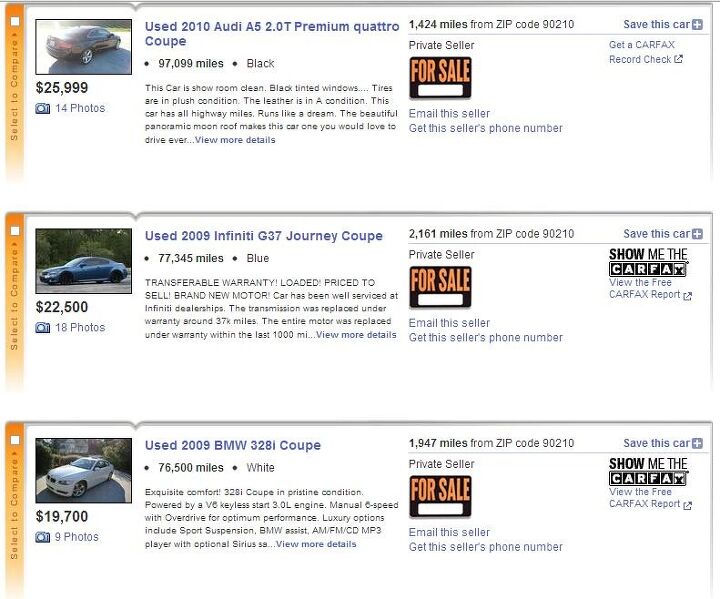

Furthermore, the leasing agreement was based on an estimated depreciation hit, whether or not the car is actually worth that amount after you’ve driven it may mean you’re getting a good deal on the car. Check the listings of similar cars and the trade in value of the car to understand how much the car is actually worth, and if your buy-back price is less than the actual value of the car, you’ve got a steal on your hands.

PLAYING SALESMAN

When it comes to deciding to buy back the lease car, you can also negotiate a cheaper price for yourself. Since the leasing company either has to sell the car on a dealer lot, or auction it off, they would rather save themselves the trouble and sell it directly to you. As long as you don’t reveal that you went over the mileage allowance, you should be in a good position to offer a nice low price, and get yourself a deal.

SEE ALSO: Should You Buy or Lease a Car?

Finally, not buying your leased car is always an option. Maybe the car you leased wasn’t reliable or what you expected. Maybe you have your eyes on another new car on the dealer lot. Leasing is great for people who don’t know exactly what they want in a vehicle, or if they want a new car all the time. The only downside is that, unlike financing or buying a car out-right, leasing doesn’t leave you with a car to call your own.

Sami has an unquenchable thirst for car knowledge and has been at AutoGuide for the past six years. He has a degree in journalism and media studies from the University of Guelph-Humber in Toronto and has won multiple journalism awards from the Automotive Journalist Association of Canada. Sami is also on the jury for the World Car Awards.

More by Sami Haj-Assaad

Comments

Join the conversation

Sounds pretty stupid to me. Then again, I treat my lease like shit.

I bought my leased BMW 335i, but just because I couldn't stand to give it back.