10 Things Your Insurance Company Knows About You

Your insurance company can’t verify the annual mileage you drive, your marital status or who in your household drives your car, so why do they ask those questions when it comes to getting an insurance provider?

We reached out to an insurance expert for answers about what you share with your insurance provider. But one thing is for sure; your contract with an auto insurance provider is about trust.

“On every insurance application the consumer is asked to sign it in order to give consent,” says Anne-Marie Thomas, a spokesperson from InsuranceHotline. “You’re authorizing the insurance company to collect and assess your driving history in order to give you insurance.” That means that your driving history and the answers you give on your insurance application is what makes up the majority of the profile that your provider has of you.

For example, on any insurance application you’re asked how many miles you drive on an annual basis. That number you provide (along with the many other answers you give) helps the insurance company assess your risk on the road. More miles mean you’re at a greater risk of being in a car accident. But does the insurance company check on the miles you’ve actually driven and compare it to the number you provided?

“Not unless the company performs an annual vehicle inspection,” says Thomas. Even then, vehicle inspections aren’t very common. Thomas says that an insurance company may request a vehicle inspection if your vehicle was in an accident and you got a cash settlement to get the work performed at a shop of your choosing (rather than one the insurance company chooses). The vehicle inspection is proof to see the work you were paid to get was actually done.

“Among the many things checked during a vehicle inspection is the mileage,” says Thomas. At that point, a red-flag could be raised about how much you actually drive the car and you may void your insurance coverage.

However, if you have a usage-based insurance provider, like Progressive’s Snapshot, all your miles can be verified with that system.

See Als0: What is Usage Based Insurance

Insurance applications also ask for your marital status. No, they’re not looking to sign you up for a singles site, but statistics show that married people tend to take fewer risks when driving. Can an insurance company check to see if you’re married or not? Thomas explains.

“Most of the time, insurance companies will pull your driving history,” she says. “That includes information from past applications and coverage, so if you showed you were married then, and aren’t now, you may be asked to explain.”

An insurance company may run a soft credit check on you.

“In the [US], there was a direct correlation between credit history and claim frequency,” says Thomas. She even warned that in some places, insurance can be denied based on your credit history.

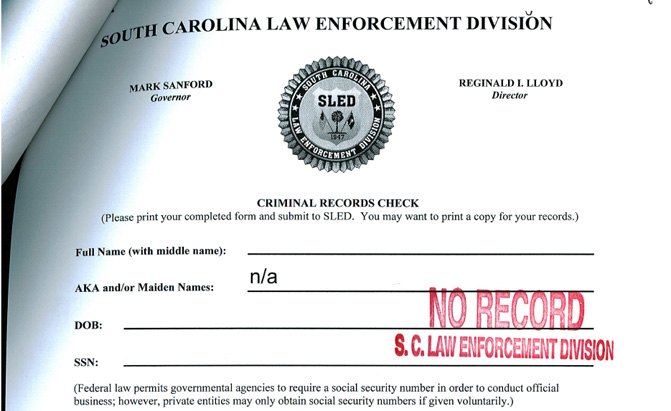

Insurance providers also care about your criminal record, if you have one. Like your credit history, you can be denied coverage based on this information.

On your insurance application, you’re asked if there are any other licensed drivers in the household who will have access to the car you’re looking to insure. Why?

“Your premiums are based on your driving record,” says Thomas. “But when another driver with a worse driving record will be a frequent operator of your vehicle, that will affect your premiums.” So if you block your roommate on the driveway, and they have to move your car every morning to get their car out, then that’s considered a frequent use of the vehicle. If anything happens to the car while he’s doing that, you may be denied coverage.

Are you going to start paying more for insurance if your teenager just turned 16 and earned a learner’s permit?

“No, insurance companies do not charge for a learners permit,” says Thomas. And there’s no way the insurance company will know when your teen gets their permit, or graduates to a full driver’s license. That means if you want full coverage of your teen, then you have to make the call to the insurance company and inform them of the new driver who will be operating your car.

“Your insurance history follows you, even as you change insurance companies,” says Thomas. “Most insurance companies will penalize you for a claim, some as old as six years.” On a more positive note, Thomas says that drivers who have ten years of claim-free coverage tend to get a discount.

Thomas also said your claim history doesn’t travel with you between countries. If you think you’re being unfairly penalized for having no claim history in your new country, you can get a letter from your old insurer that shares your clean record.

The insurance companies are always up to speed about your traffic infractions. There’s no hiding it, although Thomas explains that tickets abroad, depending on where you get them, may not always follow you back home.

“For Canadians that travel to the US, only a few states (New York and Michigan) have an agreement to share any traffic violations to home authority,” says Thomas.

You can’t hide your vehicle’s history from insurance companies either. For example, those who have a salvage vehicle that isn’t eligible for comprehensive coverage may want to keep that information a secret.

However insurance companies can pull up a CarFax or vehicle history report using your car’s VIN, just like a used car buyer.

“They won’t check every car,” says Thomas, “I’d imagine they do it randomly.”

This kind of information may also pop up during a vehicle inspection.

Can your insurance provider find out if you’ve been using your car for commercial reasons? Not unless you tell them, or if a claim happens while you’ve been using the car for a non-personal reason.

“When I was an underwriter, I had a case of a client who picked up a pizza delivery job,” says Thomas. “But when he got into an accident during the job, we had to deny his coverage because he didn’t explain that’s how he was going to use his vehicle.”

Thomas also warns against saying a vehicle is used for personal reasons, but features branding for your business. You may find yourself without coverage or have your claim denied.

Sami has an unquenchable thirst for car knowledge and has been at AutoGuide for the past six years. He has a degree in journalism and media studies from the University of Guelph-Humber in Toronto and has won multiple journalism awards from the Automotive Journalist Association of Canada. Sami is also on the jury for the World Car Awards.

More by Sami Haj-Assaad

Comments

Join the conversation

Point 6 shows that this article is a bunch of BS. Your insurance rate will go up once you claim additional new driver so why not just state it here at point number 6? Why? Because this article was designed by the insurance company.

If I "forget" to tell the insurance company that my teenage son is driving isn't the insurance company still liable? What if he's been driving for years then has an accident and I say, "Oh yeah, he just started driving I was getting ready to call you about it." Isn't the mere fact that I have teenagers somewhat factored into the rate regardless of whether they are driving? Also, why can't they just insure the driver for liability irrespective of the cars. If I'm single and own 2 equally old, non-sporty vehicles and I choose to not to insure either vehicle and just want liability, why do I have to pay double if I own 2 cars? I can only drive one at a time.