Are You Properly Insured for Ride Share Driving?

If you’ve entered the rideshare side hustle game, or are considering it, you’re not alone. More than one million Americans are already driving for at least one of the two big rideshare companies, Uber, and Lyft. You’ll need to think about your ride as well as gas prices and more vehicle maintenance, but are you properly insured for rideshare driving? You should be, and products like Toyota Auto Insurance can help you make sure you are.

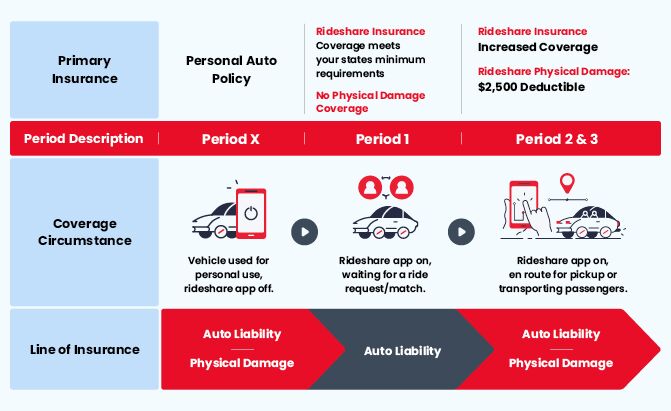

Rideshare companies do offer insurance coverage to their rideshare drivers, but you may not be covered in all situations. Plus, like all insurance products, it can be complicated. Most offer similar coverages of $1m in third-party liability, some uninsured motorist coverage (good if you’re hit by an uninsured driver) and comprehensive and collision coverage. But this coverage only applies when you’ve got a rider in the vehicle or are on your way to a pickup and it won’t cover your medical costs if you’re injured. For instance, popular rideshare platforms may have a $2,500 deductible for collision and comprehensive, and the other coverage limits vary based on where you’re driving.

Waiting for a ride request? You’re looking at coverage that may only comply with your state’s minimum requirement, plus it’s all third-party liability. Coverage of your own vehicle and your medical costs isn’t included. Get hit while backing out of the rider’s driveway and you could be looking at a big bill.

Photo by Mat Hayward /Shutterstock.com

Coverage Periods

It seems complicated, but it’s generally broken down into three periods of time.

Log in to the app and you’re in Period 1. Standard personal policies typically cover you since you’re driving for hire now. So, you’re relying on the coverage provided by the rideshare company.

Period 2 starts when you accept a ride and head to a pickup, with Period 3 being the time while the rider is in your vehicle. These are the times when the company commercial policy

After drop-off, as you wait for your next ride, you re-enter Period 1. Sign out of the app and you’re back into your personal coverage.

Confusing? Sure is, but what you need to know is that just relying on your standard insurance coverage coupled with the rideshare policy could still put you, your vehicle, and your finances at risk of big payouts.

But you should know there are insurance products available to help protect you. Offering you coverage during your personal time when you’re signed out, adding coverage during Period 1, and even improving your coverage during Periods 2 and 3.

What about renting a car to drive and earn?

Services like KINTO Share let you rent a vehicle specifically to drive it for rideshare or delivery app work. Don’t want to put miles on your car or don’t have a vehicle that meets the requirements of the big services? Try KINTO Share.

When you rent from KINTO, mileage, maintenance, and insurance are included in the cost, but, like all insurance, there are limits. KINTO covers up to $25,000 in property damage as well as state mandated minimum liability coverage, but the service doesn’t cover the cost of your medical bills in the event of an accident. That goes back to your personal insurance coverages which may or may not apply.

What Coverage Do I need?

This is an add-on to your existing policy that makes sure your insurer knows that you’re doing rideshare driving and that the rideshare company has agreed to insure you during some of those times. Yes, it’s more expensive, but being uninsured can cost you a lot more. Not every insurer will let you add a rideshare endorsement to your policy, though, and they aren’t available in all states and regions.

Commercial auto insurance is another possible option for anyone doing rideshare driving but who can’t add a rideshare endorsement.

Will your insurance go up if you’re driving for hire? The short answer is yes. Even if you decide that your standard personal coverage is enough for you, and aren’t worried about potential gaps, your premiums will probably increase. If you’re driving rideshares, you’re going to be driving more miles than you were before. Insurance companies rate your policy based on dozens of factors, but a big factor is how much you drive every year. The more you drive, even if the extra driving happens during the rideshare period, the more likely it is your premiums will increase.

When it comes to insurance, especially rideshare coverage, it’s key that you know what your policy includes. Can’t afford the $2,500 deductible, for example? Buying an insurance product that lets you lower it should be near the top of your list.

Other policy perks to consider include rental reimbursement coverage. This gives you a vehicle to drive to your day job as well as for your rideshare gig if your vehicle is damaged while driving for hire. If you are using a standard personal policy with rental reimbursement, you might not be able to use your rental for rideshare at all.

How do you get these coverages? Where available, Toyota Auto Insurance offers a wide range of insurance coverage options including Side Hustle Auto. Side Hustle Auto is designed to help fill in the gaps that may fall in-between your conventional auto insurance policy and the rideshare app insurance, helping you have the coverage you need to protect yourself and your vehicle in the event of a crash or claim.

Side Hustle Auto from Toyota Auto Insurance gives customers one more big benefit we haven’t talked about already. If you’re hurt or your vehicle is put in the shop, you could spend days, weeks, or longer not working. Loss of income and coverage for your business property is part of the coverage and can help make sure you’re getting paid even if your hustle has been slowed down.

Feature Image Photo by Tero Vesalainen /Shutterstock.com

*This is a sponsored article

Evan moved from engineering to automotive journalism 10 years ago (it turns out cars are more interesting than fibreglass pipes), but has been following the auto industry for his entire life. Evan is an award-winning automotive writer and photographer and is the current President of the Automobile Journalists Association of Canada. You'll find him behind his keyboard, behind the wheel, or complaining that tiny sports cars are too small for his XXXL frame.

More by Evan Williams

Comments

Join the conversation