How To Shop for Truck Insurance

Looking at bringing home a new truck? It might be time to review your insurance policy to make sure you have the right coverage. Truck insurance for your pickup is largely the same as car insurance for your car. So, switching to a pickup doesn’t necessarily mean you have to switch to a different policy, but there are differences. Here are some tips to help you shop for truck insurance that fits your needs.

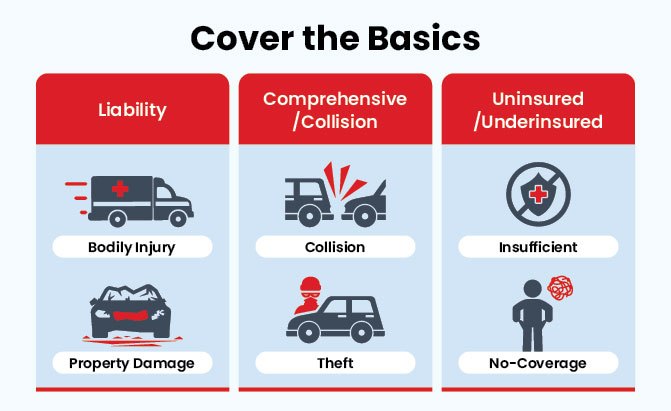

At its most basic, your insurance should cover you against three main risks. Liability insurance covers you if you are at fault for another person’s injuries or property damage. Physical damage coverage (also called comprehensive/collision coverage) protects you from the financial risk of damages to your truck in the event of a collision with another vehicle or object, or if your truck is stolen and/or vandalized. Lastly, uninsured, or underinsured motorist coverage protects you if you if you’re not at fault, but the other party has insufficient or no coverage.

Modification Coverage

If you plan to upgrade or modify your new truck it may be outside your existing policy. A standard auto policy might offer a small amount of coverage for aftermarket modifications or additional equipment up to $1,000, maybe less. But for upgraded wheels, lift kits, custom paint, stereo upgrades etc. you should speak to your insurance agent about a modification endorsement. Even so, modification endorsements do have limits:

- There can be an additional deductible in addition to your standard deductible

- The cost for installing accessories and add-ons may not be covered

- Look for terms like “actual value” and “replacement value”. As an example: replacement value could cover the cost of a new lift kit, but actual value might only cover the price for a used lift kit.

Be sure to ask questions like:

- What would your coverage pay if your modified truck is totaled?

- How are the payouts calculated?

- What documentation is needed?

In short, if your standard auto insurance does not offer protection for your modified truck, you may need to consider additional coverage.

Towing Impact

A conventional pickup can pull around 12,000 lbs. A trailer designed to tow boats, cars, ATVs, or general cargo may be covered under an auto policy for your pickup, but probably not for comprehensive or collision. It is in your best interest to make sure your policy fully covers that trailer when you are towing. Statistically, trailer use can mean a higher chance of a claim and more expense when a claim is made.

It is unlikely that your plans include hauling an empty trailer all the time. This is another area you need to make sure is covered. The policy that covers the trailer may not necessarily cover the boat, ATVs, new appliances, or furniture being transported. Your trailer contents need to be insured, and that is something that can be overlooked when evaluating insurance for your new pickup.

Towable recreational vehicles (RVs) usually need to have their own coverage as well. When you bring your mobile house along with you, your typical auto insurance policy isn’t priced to take that risk into account. Recreational vehicle policies protect your home-away-from-home and can also provide coverage when you are not towing it.

If you don’t own a trailer or a towable recreational vehicle but plan on renting one on occasion, you should bring that up with your insurance provider as well. Discuss with your agent how your policy will cover a rental trailer/RV. If your policy does not, then make sure to purchase the policy offered by the rental company.

Photo By Virrage-Images/Shutterstock

Work vs Personal

Based on how you plan to use your truck, a personal auto policy is not the same as a commercial policy. If you are planning on using your pickup for work-related purposes, your standard auto policy may not be enough. Work use could mean making deliveries or driving to job sites to complete estimates or quotes. It can also mean picking up supplies, driving around clients, or even just carrying the tools you need every day as a skilled tradesperson.

If you think you might be using your truck for work, then a commercial policy might be best for you. A standard policy won’t cover your work truck, and it won’t protect you from the risk of your valuable tools being stolen. If that happens, it’s on your homeowners or tenant’s insurance, and they might not cover your pricey gear.

Size Matters

Trucks are heavier than cars, and that weight varies by model. That extra weight (and size) can cause more damage to property and vehicles and can add to your premiums. However, vehicles like the Toyota Tundra are engineered with a composite bed and aluminum panels that help lower the vehicle’s base weight.

Assisting Features and Systems

Depending on what you are looking for, truck packages can come loaded with safety and tech features. Telematics that are part of your connected Toyota take advantage of the information from these onboard systems and can help save you money. Where available, a usage-based insurance service, enabled by Toyota’s Insure Connect can help you save money insuring your new truck.

Toyota features that can help reduce the risk to insurers include a wide array of standard and available advanced driver assistance systems. Toyota Safety Sense 2.5 is included on all Toyota Tundra models and offers a pre-collision system with pedestrian detection to help stop your truck in an emergency you haven’t seen, lane departure alert with steering assist to prevent the truck wandering out of the lane, and automatic high beams to help you to better see obstacles at night.

Available features like the Panoramic View Monitor, Blind Spot Monitor, and Trailer Backup Guide System with Straight Path Assist can help you to avoid collisions and property damage. With your new truck, it might also be time for a new insurance policy. Toyota Insurance Management Solutions can help answer any questions you have about insurance and offers a comprehensive line of products for all your insurance needs.

Feature Photo By CrispyPork/Shutterstock

* This article is sponsored by Toyota Insurance Management Solutions

Evan moved from engineering to automotive journalism 10 years ago (it turns out cars are more interesting than fibreglass pipes), but has been following the auto industry for his entire life. Evan is an award-winning automotive writer and photographer and is the current President of the Automobile Journalists Association of Canada. You'll find him behind his keyboard, behind the wheel, or complaining that tiny sports cars are too small for his XXXL frame.

More by Evan Williams

Comments

Join the conversation