Should You Bundle Your Insurance Policies?

You’ve heard the promise in every insurance commercial: bundle your policies and save!

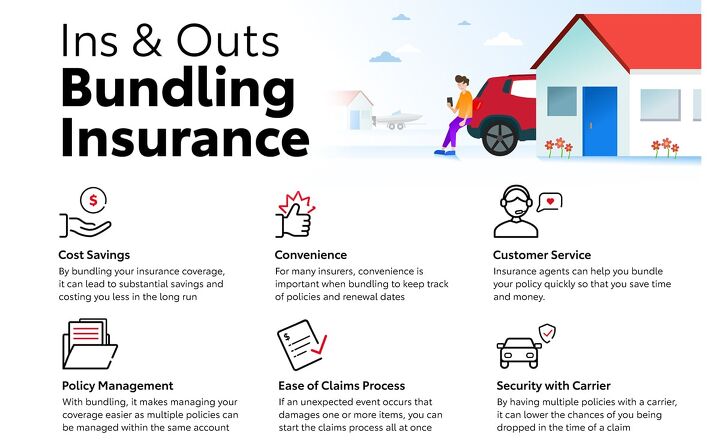

But what exactly is bundling, and is it the right option for you? Bundling is actually very simple: it’s purchasing multiple policies, such as home and auto insurance, from a single carrier. Regardless of the carrier your insurance policies should be tailored to meet your specific needs, so it’s worth doing your own research to decide if you should bundle. Below, we’ll outline the pros and cons of this insurance strategy and highlight the questions you should ask anytime you’re shopping for coverage.

COST

Most people choose to bundle their insurance policies to receive a discount, which is referred to as a multi-policy, multiline, or multiproduct discount, but to ensure you’re saving as much as possible you should compare the discount with similar policies from a variety of carriers.

For example, your bundled policy with Company A might cost $200/month after a 10% discount. But perhaps you could buy separate, similar policies from Company B and Company C for a total cost of $175/month.

In addition to comparing rates, keep in mind that original discounts could be eroded over time if your carrier consistently raises the cost of your plan. Don’t let the promise of a discount keep you from crunching the numbers! That being said, there are more reasons than just cost to consider when it comes to bundling.

COVERAGE

Always dig into the details of your policy before you purchase. You should be sure you know exactly who your insurer will be—some companies will farm out certain policies to affiliates, leaving you with multiple insurers despite the promise of a “bundle.” You’ll also want to look at the details of each individual policy, making sure it can be customized to fit your needs. The coverage offered by bundled policies should be just as comprehensive as it would be with separate policies from different carriers.

If you’re holding back on bundling because of anticipated life changes—you’re currently purchasing car and home insurance, but know you’d like to switch to a different carrier in the near future. Ask your agent if a multi-policy discount can be applied by the new company in advance. Many carriers will apply the discount if you’re willing to commit to bundling ahead of time.

QUALITY OF SERVICE

Convenience is a major factor when deciding whether you should bundle your policies. Making a single payment to a single carrier each month makes life easy and could also make the claims process simpler.

As always, it’s important to do research ahead of time to ensure you’ll actually enjoy the simplified experience! For example, a carrier may be well-known for their customer service when it comes to auto insurance but might be reviewed as slow to address claims on home insurance policies.

Reading customer reviews and finding claim data for various insurers will help you understand the strengths and weaknesses of each, and will allow you to make an informed decision when it comes to bundling

IS BUNDLING RIGHT FOR YOU?

Whether or not bundling is right for you will depend on what you value most—cost or convenience? —and your specific needs. If you’re still unsure, seek out an independent insurance agent from Toyota Insurance who can answer all your questions and price policies from a variety of carriers (as opposed to dedicated agents that can only sell the products offered by their company).

*This is a sponsored article by Toyota Insurance Management Solutions

More by AutoGuide.com News Staff

Comments

Join the conversation