Protecting What's Precious: An Overview of Home Insurance

Buying a home is a lengthy, complex process that tests the patience of even the most organized individuals. When it comes to protecting the place you call home, it is imperative that finding appropriate insurance coverage is part of the home buying process. If you are financing your home most banks and mortgage lenders require home insurance to approve your loan, but regardless of how you go about purchasing, home insurance is a practical step you can take that can help you mitigate financial hardship down the road. Like car insurance, not all policies are created equally, making it important to shop around to find the right combination of coverage and price. To help, we have put together a practical overview of all the information you will need to decide on a policy that fits your lifestyle and budget—read on and shop with confidence!

First of all, it is important to understand that homeowner’s insurance covers more than just the physical structure of your home. It also covers your possessions, potential liability to guests that are injured in your house, and more. So, when it comes to finding a policy, you will want to start by establishing how much coverage you will need. Determine what it would cost to rebuild your home based on the current cost per square foot in your area. You should also document your possessions in photos or video and estimate how much it would cost to replace your belongings at current cost (not what you paid for them originally). This gives you a baseline for the coverage amount you’ll shop for.

When you begin shopping around, you’ll find there’s no shortage of options for home insurance, so narrowing down your options can be a helpful place to start. What are your priorities when it comes to an insurance carrier? Would you prefer a local agency or the convenience of an online-only company? Are there specific coverages a company needs to offer? Is a high customer service rating particularly important to you? Establishing your “must haves” will automatically narrow your options, making it easier to begin collecting quotes. It is important to remember that a home insurance quote is an estimate of coverage types, limits, deductibles, discounts, and premiums you can expect to pay based on the information you provide.

In order to effectively evaluate and compare home insurance quotes, be sure you are receiving quotes for similar levels of coverage by having the following information to hand before you begin shopping:

- Age of home and construction type (brick, wood frame, etc.)

- Location (precise address)

- Safety devices (fire or burglar alarm systems, etc.)

- Square footage (including your garage)

- Number of floors and bathrooms

- Special features (fireplace, deck, garage, swimming pool, etc.)

- Type and age of roof

- Type of foundation (and any relevant info re: repairs)

- Pet information (species, breed, weight)

All of the above information can impact the cost of insuring your home and should therefore remain consistent throughout the estimate process. Homes close to a fire station and/or hydrant, for example, may receive better rates. The age and condition of major systems like plumbing and wiring will also impact your premium—older systems are more prone to damage and may need to replaced sooner rather than later, increasing your overall rate. An unintentional mistake or omission on an insurance application could result in higher rates, denied claims or cancelled insurance following a future claim to rebuild, repair or replace any part of your home. An independent agent can help ask the right discovery questions, find discounts, and shop different insurance carriers to make sure you find affordable home insurance options that are right for your budget.

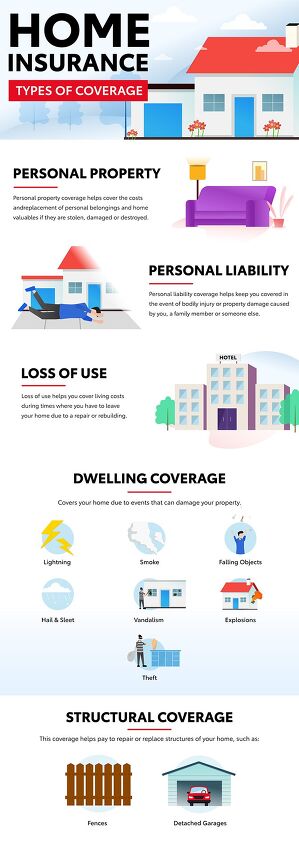

Your final policy will be a collection of coverage types, the combination of which should result in comprehensive coverage for your home and everything in it. Personal property coverage is insurance for your possessions, though high value items like jewelry and fine art may require separate, special coverage. Liability insurance protects you against a claim of physical injury or damages sustained on your property or in connection with your property. Dwelling coverage applies to the structure of your home and certain “perils” that can damage your property, like lightning, smoke, hail, theft, and vandalism. Loss of use, also known as additional living expenses (ALE), helps pay for additional costs you might incur if a covered event makes your home uninhabitable for a period of time. Supplemental Medical payments coverage will pay the medical bills of people who are accidentally hurt on your property (not including members of your household). You should read over and carefully evaluate each of these categories of coverage before deciding to purchase a policy.

Whether you want to walk through the entire quote process with an insurance agent or handle it on your own, it is easy to get a quote online or over the phone. Some carriers will allow you to begin the process online but require you to speak with an agent over the phone before receiving the final estimate. Many online-only carriers, on the other hand, require an inspection of your home (either by you or a professional inspector) to determine if you need a different amount of coverage. Regardless of how you go about getting an estimate, doing so should never cost you money, so steer clear of any sites or companies that ask for payment for a quote.

On a final note, it is worth mentioning that increasing storm activity and frequency of natural disasters is driving up premium costs. If you live in an area prone to flooding, storm activity, or other environmental events you can expect to pay more for home insurance. And with approximately 64% of homes in the United States underinsured, it’s vital that you factor in the cost of insuring a property into your homebuying process so you can rest assured that you’ll be able to afford the appropriate amount of protection. A comprehensive home insurance policy grants you and your household peace of mind when it comes to protecting what’s precious to you.

*This is a sponsored article

More by AutoGuide.com News Staff

Comments

Join the conversation