The AutoGuide Guide to How To Buy a Car

Just 25 years ago car buying was relatively simple, if still a headache. Unless you were after a high end luxury, sports, or collector car, all your new car choices were on the lot at your local dealership; and there were 100 pages of used car classifieds at every checkout. Or you could always bring your wallet down to Yetarian’s Premium Deluxe Motorsport and take your chances with their low, low, prices. Only a few diehards would think about having a car shipped in from somewhere or taking European delivery of their Volvo or BMW.

How To Buy a Car Has Changed

In the post-pandemic era, the way we buy cars has changed forever. For this guide, we talked to industry insiders, manufacturers, and consumer credit experts, all of whom agreed: How to buy a car in 2022 and beyond will never again be like 2019 or before: “We don’t expect that the industry will ever go back to a place where dealers hold large amounts of inventory,” General Motors’ Sabin Blake told us. Honda’s Chris Naughton agreed: “The whole car industry has changed in recent years, with on-ground inventory being much lower than had been typical for decades,” he said.

To navigate this new world for car buyers, the most important things you can do are to take your time and know what you’re doing. The last step in your process should be talking to someone with a car for sale. “Knowledge is power, and there is no cost associated with doing your own research,” said Stephanie Hsu, head of product for Credit Karma Auto.

It’s an extremely hard time to figure out how to buy a car. Inventories are low and prices are high. You may have to skip some steps in our guide, but it will help to read the relevant parts. And if you have any questions, tips, or suggestions; or want to share your car buying experiences, please let us know in the comments.

Table of contents

- 1: Before You Begin

- 2: State of the Market

- 3: Should I Repair or Replace My Car?

- 4: Know your budget

- 5: Auto Loan Calculators: How to Estimate Your Monthly Car Payment

- 6: Warranties and other add-ons

- 7: Insurance

- 8: Trading in Your Vehicle: The Pros and Cons

- 9: Selling Your Vehicle Yourself: The Pros and Cons

- 10: Know Your Way Around a Dealership

- 11: Buying New Vs. Used

- 12: Research Vehicles and Features

- 13: Locate and Test-Drive Cars

- 14: Consider Your Buying Options

- 15: Addressing Problems After a Car Purchase

- FAQs

1: Before You Begin

If you have excellent credit of over 740 or so; own a late-model car; and have either financed a car before or are able to pay cash, then you can skip Section 2. For everyone else, this is the time, literally today, to start budgeting and working on your credit. If you can wait even three months for your next car, you might be able to improve your credit enough to get a better car loan, while saving for a bigger down payment. We really mean it: Read the next section and at the very least, get your free credit report before you do anything else.

How To Improve Your Credit and Get Better Loan Rates

You should start by getting your free annual credit report, which may not include your credit score, but will tell you if your credit score has accurate information. You can get a free estimate of your score (usually within 10 points) from Credit Karma and other organizations. Unless you’re already in the Excellent category, you’ll benefit from exploring ways to improve your credit, which includes paying down debt. If your score is below the 620-640 range, you’ll find it harder to get a loan at all, and you may be forced into expensive and often predatory subprime financing.

Organizations Which Can Help With Credit and Debt Management

The nonprofit National Foundation for Credit Counseling can help almost anyone work to repair their credit, including debt consolidation; and joining a local credit union (it’s just like starting any other bank account, except it’s a nonprofit) will usually give you access to lower interest rates when you get preapproved for a loan. Some credit unions and other lenders have their own credit building plans, or are community development financial institutions (CDFIs), which can have special funds to help people with lower incomes or poor credit get better loan rates.

Many other local nonprofit organizations offer more personalized approaches, are CDFI members, or participate in the national Cities for Financial Empowerment Fund. If you’re over 50 (and even if you’re not), AARP has a good resource center for managing money and debt, and additional services available to members. The VA has an automobile allowance and adaptive equipment disability benefit that can provide a one-time payment to help buy a car, as well as additional information on loans for veterans. Union members can access the AFL-CIO’s Union Plus auto buying service for discounts, rebates, and financing help.

2: State of the Market

Summer 2022: It's not great

Rising interest rates are making car financing even more expensive now, but the semiconductor (chip) shortage that’s been the largest single factor in new car shortages is getting better. This should slow down, but not stop, the inflation in new and used car prices, which will keep rising. Our honest advice is to wait as long as you can to buy.

When to buy a carIf you can’t make it with your current car until new models arrive starting in October—when you should shop for an outgoing current year vehicle— or the end of the year, at least don’t buy until the last few days of the month, preferably at the beginning of the work week, and not on a weekend.

3: Should I Repair or Replace My Car?

Do you want a car, or need a car? If you can wait, you should, unless you just want the newest and fanciest for fun, in which case money is not your first priority and you should totally get something great.

High car prices should guide your decisions about repairing and otherwise keeping the car you have on the road for longer. While you don’t want to waste your money, if a replacement used car is $25,000, it might make sense to spend $7,000 on a new engine and transmission. Driving your old car could also be a more environmentally friendly option (if you don’t drive a ton and you’re already getting good gas mileage), too, as your car has paid its carbon debt long ago.

Good money after badOnce you've spent money on your car, pretend it never existed. Photo credit: David Traver Adolphus / AutoGuide.com.

If the vehicle you drive isn’t doing the job for you, one of the things that makes it hardest to figure out if you should repair or replace your car is the Sunk Cost Fallacy. Humans are very bad at making decisions when we’ve already spent a lot of money on something, especially when it comes to cars. “I spent all this money on my car already, I can’t throw that away.” Maintenance is not an investment, that money is gone. No one is paying you more for your car because you put thousands into rebuilding the worn-out suspension, they’re just not paying you less. Look closely at how much you’re putting into it now, not what you have spent, vs. the value of the car. On the other hand, used vehicle trade in values at the dealership are high, as well.

4: Know your budget

We’re car people at AutoGuide. We love talking about them, working on them, driving them, looking at them, but even we agree that your entire car shopping journey should start with a clear look at your financial situation. “...The most important thing you can do before starting the shopping process is understanding how much car you can afford, and making sure your budget reflects that,” said Credit Karma’s Hsu. “Remember, the full cost of car ownership goes beyond the sticker price—you’ll want to factor into your budget costs for financing, if you choose to finance the car with an auto loan, auto insurance, maintenance and repairs, and sky-high gas prices.”

Auto Loans

You’ve read our Before You Begin section on credit and done all the preparation you can. If you’re not a cash buyer, it’s time to talk to a lender.

Financing Your Vehicle

“If you’re planning to finance your car with an auto loan, get pre-approved,” said Hsu. “Getting preapproved for an auto loan gives you a good understanding of how much you can borrow for a car, and insight into the interest rate and loan terms. While this can make it easier to understand the total cost of the loan so you can create a budget before beginning to shop for a car, it can also give you some flexibility to choose which dealer you want to work with as you may find you’ll have more negotiation power.” If you walk into a dealer with a 3.9% loan pre-approved, the finance office has an incentive to try to beat that, rather than sticking you with the highest APR they can get away with.

Fraud in auto loansA recent Consumer Reports investigation found widespread fraud and discrimination in car loans. Visit a reputable loan marketplace like Lendingtree or Nerdwallet when shopping for the best rates, and always check for any complaints with BBB. For instance, the Pentagon Federal Credit Union, PenFed, pops up on many lists for best car loan rates but is not BBB accredited.

Be careful of too-good-to-be true online lenders, which may have hidden fees, balloon payments, promotional rates that rise after the first year, or just terrible customer service. If you can, we recommend borrowing from your local bank or credit union.

Older cars cost more to financeYour credit rating isn’t the only thing that will affect your loan rate: Lenders have tiered rates that charge a higher APR for older cars. At the same time, Kelley Blue Book values for used cars haven’t kept up with how fast prices have risen, so for older cars it can be hard to get a large enough loan. And most lenders have an age cutoff—many won’t issue auto loans for cars more than 10 years old at all, which means you have to take out a personal loan at higher rates. We’ve seen those rules start to relax a little recently, though, and this is another area where a credit union may be more flexible.

Longer loan terms cost moreDealers and banks both have an incentive to get you to take a longer loan: They make more money on them. Sixty months—five years—used to be a long term, but lots of people are now taking out 72 or 84 month loans. A 36 month new car loan might have a 1.89% interest rate, but the 72 month one could easily be triple. Over the course of five, six, or seven years, a percentage point more will mean you pay thousands of dollars more in interest.

Dealer financingA reputable dealership will give you a good interest rate, but you can’t count on it. In fact, a dealership is under no obligation to give you the best APR at all. "People are being charged more for interest rates than they should be based upon their creditworthiness,” the National Consumer Law Center’s John Van Alst told NPR. Always walk in with pre-approved financing, and see if the dealer can beat your APR and terms.

LeasingIf you’re negotiating to buy a new car and a dealer offers you a lease, that should be a red flag. Leases make the dealer more money, especially now when a car might be worth more at the end of the lease than new. “Dealers generally make more money off leases compared to sales, so if they try to sell you on a lease, understand it’s likely not out of your best interest,” said Hsu. “That’s not to say leasing doesn’t come with benefits that might complement your lifestyle and financial needs better, but make sure you understand all the tradeoffs, and make the decision that’s best for you.”

Lease terms are also worse than they used to be. What was once a 12- to 15,000 mile-a-year deal is now more often 10,000 miles, with very expensive penalties for going over. “Besides cutting mileage allowances, lease providers have also been limiting the incentives they used to offer (such as cash rebates or subsidized interest rates),” reported CNBC. If a car’s value goes up during your lease term, you’re paying the dealership to make money.

5: Auto Loan Calculators: How to Estimate Your Monthly Car Payment

To calculate your loan payment, you’ll need to know your purchase price, down payment, any trade-in, and APR. Credit Karma has a good loan calculator, as well as a very helpful lease vs. buy calculator. You can play around with loan terms in months, interest rates, and other variables, to see what the best option is for you. If you already know your budget, use Nerdwallet’s reverse loan calculator to see what your monthly payment can buy. This will also tell you how much of your repayment will be interest.

Monthly automotive budgetConsumer advocates recommend spending no more than 15% of your total pre-tax monthly income on everything car related, including payments, insurance, maintenance, DMV registration fees, parking, and fuel. That’s impossible for many people when the average used car is over $28,000 and the average new car is over $46,000, but it’s a target to aim for.

6: Warranties and other add-ons

Car dealers sell extended warranties because they make money on them. We’re not aware of any manufacturer in North America that doesn’t have at least a 36 month/36,000 mile basic warranty, and five year/60,000 mile powertrain warranty. Many offer four years and 50,000 miles, while Hyundai/Genesis, Kia, Jaguar, and Mitsubishi have five years/60,000 mile warranties; and VW has a great six years/72,000 miles.

Extended warranties and other add-ons like service contracts are a way for the dealer to tack some extra dollars onto your loan payment. If these are legitimate offerings, you should still be able to purchase that coverage any time during the original factory warranty period. There’s no reason for you to add to your loan if you’re not going to own the car in four years, and they are often not worth it at all.

Unscrupulous dealers will sometimes fold those into the price without ever talking about it. Take notes during your negotiations, and make sure the numbers add up at the end. You can always stand up and walk out at any time.

7: Insurance

Car insurance is another thing you should have prepared before you buy, although it’s not part of the buying process. You won’t be able to get insurance on a car until you own it, but you can and should get a quote on the models you’re thinking of buying. If you’re driving a car home from a dealership and car shopping on a weekday, you’ll be able to contact your insurer from the dealership and print out proof of insurance. Buying a used car from a private party is generally a little more complicated, but you should still talk to your insurance company first. They can usually have a policy ready to go as soon as you send them your new car’s VIN.

Insurance ratesIt’s also a great time to shop around for a better deal from a new insurance company. Sites like Nerdwallet and Credit Karma have comparison tools; and other organizations including AAA and many labor unions have their own discount programs. There’s no reason not to get multiple price quotes for insurance, just like you would for financing.

8: Trading in Your Vehicle: The Pros and Cons

You’ll make more money selling your car on the open market, but with used car prices so high, the dealership is going to work hard to get your trade-in: “Current car owners in the market for a new car have a leg up on first-time buyers since they’ve more than likely seen their car appreciate in value over the past year, enabling them to counteract some of that sticker shock with their trade in,” said Hsu. She said that in July 2021, Credit Karma analyzed the values of people who had their cars synced to their platform, and found that 25 million vehicles had seen a median retail value increase of around $1,750 in the last three months. “75% of members [saw] an increase between $400 and $4,400,” she said.

Know how much your trade-in is worthWhether you’re selling it yourself or trading it in, you need to know how much your current car is worth. Most people overestimate the condition of their car, so be critical when deciding if it’s in poor, fair, good, or excellent condition. If you’re lucky enough to own something in high demand and short supply like a late-model Toyota, Jeep, or Tesla, an extra scratch or chip here and there is not going to affect private party value, but it might be a reason for a car dealership to lowball you. Use tools like Edmunds.com's True Market Value, which will help show the difference between trade-in and private party purchase price. However, it can be inaccurate for low volume models, so we like to look at things like eBay sold listings, which with a little searching, will show actual transaction prices near you.

9: Selling Your Vehicle Yourself: The Pros and Cons

You can take almost any halfway decent running car to a dealer and get an offer, but individuals are going to be a little pickier. To get the best money, your car will need to be clean and work properly, inside and out. You’ll need to fix any little things that are wrong, t ouch up the paint, and keep it ready to be shown.

Protect yourself when selling your used carWord of mouth with your friends or coworkers is often enough to find a buyer. If it isn’t, or you want a wider audience that might pay more, no matter how you advertise it—Craigslist, AutoTrader, eBay—be prepared for some scammers. Only accept cash or a certified check, never a money order, and be very wary of a cashier’s check. Only take payment in person, and don’t take payment via Paypal, Venmo, or wire transfer. If you’re into cryptocurrency, you’re beyond our help, but 31 apes for a Ford F-150 probably isn’t a good deal.

10: Know Your Way Around a Dealership

Making a call, filling out an online inquiry, or walking through the door of a dealership tells a salesperson that you’re interested in buying a car, which starts you off at a disadvantage. Your job is to turn that around, while staying positive. “Car salesmen get a bad rap and probably deservedly so,” car salesman Josh Lewis told us a few years ago. “This is your money; this is what you’ve been working for. Don’t let somebody just play around with it.” You have money, and they want it, but you don’t have to give it to them. Doing your research and financial preparation helps you negotiate from a position of strength. Don’t volunteer any information about your finances that you don’t have to, and you can always walk away.

Working with car salespeople

At the same time, you don’t want to make an enemy: “It’s all about attitude. I’d much rather be of assistance to someone that’s a little bit open to listen to my opinions than someone that’s going to come in and tell me how to do my job,” said Lewis. “Once you establish that line of credibility they back down, you back down…It becomes less of ‘how I can take advantage’ and more of equals.”

Your loan pre-approval and research about the car you’re looking at will help you start out in a stronger place as you work towards the best price.

11: Buying New Vs. Used

Buying a late-model used car is a lot more like a new vehicle purchase than it used to be, if you can find one at all. In fact, it’s so competitive that General Motors just announced they’re turning their nationwide new car dealerships into a used car business like CarMax or Carvana. Starting later in the summer of 2022, “We will offer GM and non-GM vehicles with competitive warranties and many owner benefits like courtesy transportation and roadside assistance,” said GM’s Sabine Blake.

Pros and Cons

A used car is more work than a new car purchase. If you’re buying private party there are more trips to the DMV; and no matter where you buy it, you have to figure out the fair price of the car. It can be impossible to talk a seller into letting a mechanic do an inspection, and there might not be other options. At the very least, search for a buyer’s guide for that make, model, and year; or visit a forum and ask what to watch out for.

Even if it’s just in the driveway, get under the car and look for leaks and damage, or bring a knowledgeable friend to help you out. Look closely for uneven panel gaps and different paint textures that can help you figure out if collision damage has been repaired. If you can, pull up carpets and look under the spare tire for rust or silt, a telltale sign of flooding.

The Carfax reportA Carfax, which shows the ownership and service history of a vehicle, isn’t perfect. It only shows repairs and maintenance done by dealership service departments, and more reputable shops. But it will tell you very helpful things including everywhere it’s been registered—like in the rust belt—the number of owners, and damage severe enough to give it a Salvage title. If a Carfax shows that a vehicle has bounced through multiple owners or sat for a long time, you should look into why. You do have to pay for a Carfax, but we think it’s worth getting when you’re serious about a car. Many dealers will provide one for free, and you should always ask if they don’t volunteer one. Read Dashboard Light’s guide to understanding a Carfax for more.

12: Research Vehicles and Features

Don’t let a dealership sell you add-ons you don’t want or need. There’s no room to negotiate on options or features, and you have no idea what their markups are (hint: very very high). If you want a set of running boards or a rooftop cargo box, you can add those any time, and you’ll have many more options on the aftermarket.

Safety

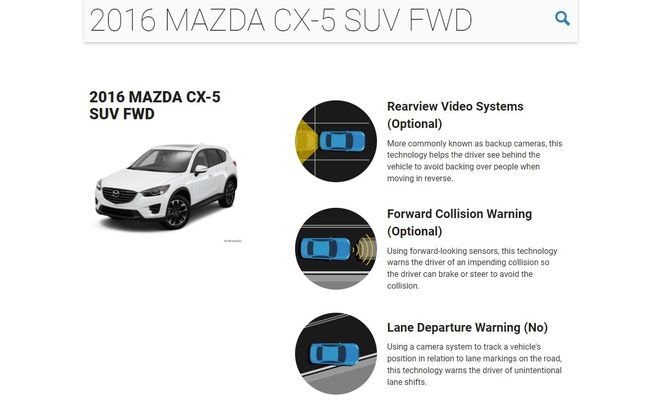

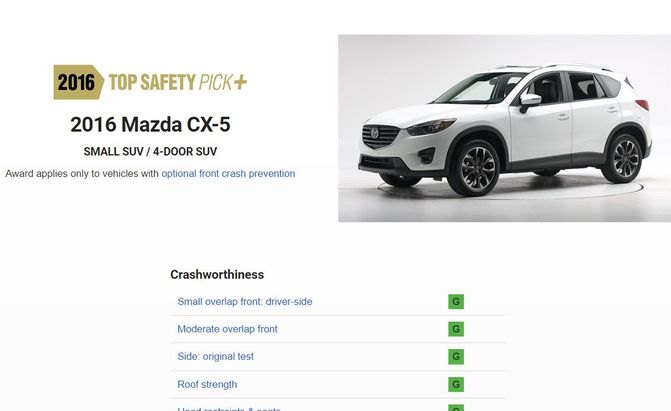

The gap in standard safety features is rapidly narrowing, both through competition and through regulation. You can search for any make and model at the National Highway Traffic Safety Administration site, and it will tell you what safety technologies are standard, and which ones are optional, both for new and used vehicles.

The Insurance Institute for Highway Safety conducts independent crash testing, and will not only give you an overall rating, but detailed breakdown of how the vehicle performed in many categories. There are even crash test videos and photos for most late model cars.

Quality

One of our favorite tools, especially for used vehicles, is the Long-Term Quality Index. Steven Lang’s site aggregates data and flaws and faults from millions of auction sales. You can search by make and model, or by category, and see not only which brands do well (spoiler: It’s always Toyota/Lexus), but which years might be a standout, one way or the other. For instance, Ford F-150 ratings improved dramatically after 2015, but they should be avoided before 2009 (looking at you, Triton engine family).

You’ll see J.D. Power ratings advertised frequently, and while they have some value, there are a lot of questions about how well they represent real-world experience. J.D. Power does not conduct independent research, instead, they collect owner questionnaires. Nissan's Sentra has multiple J.D. Power awards, but poor long-term quality and underwhelming road test reviews.

Expert Opinions

As professional road testers and car evaluators here at AutoGuide we say: Take all of us car reviewers with a grain of salt. We like Consumer Reports’ thorough testing, but the reviews can be short and you have to pay for access. And that’s about it for nonprofit organizations that test cars. You should read professional reviews both from outlets like AutoGuide and MotorTrend, and places like Edmunds, which does a good job of breaking down features and options.

Owner Opinions

We always read owner’s reviews, but often it’s people with complaints who write them. Cars.com has reviews not just of cars, but of dealerships, when you search for a car.

You can get more personalized information from a car-specific forum, where you can ask questions and talk to people who are enthusiastic and knowledgeable about the specific cars at which you’re looking.

Side-By-Side Comparisons

Buyer’s remorse is very real. A recent survey found that 23% of Americans who had recently purchased a car regretted it. Take some time to make sure you’re getting into the right kind of car. SUVs and crossovers are everywhere, but if you’re moving a lot of people and gear, a minivan has more room inside and often gets better mileage than a three-row SUV. All-wheel drive cars get worse mileage than front-wheel drive, so ask yourself how much time you’ll be spending on muddy trails or in deep snow. ”While sedans were once the bulk of the market, SUV’s have become the dominant vehicle type,” said Honda’s Chris Naughton, who points out that less-popular body styles like this are going to be both easier to find, and command less of a price premium.

Write down your basic needs: How many people you need to transport, what conditions you’ll be driving in, and how much fuel will cost you. If an EV is on your list, is there a service center close by that can service it, or will you have to travel? As you look at new car comparison tools, use ones that let you choose the specific features you want, like Autotrader’s advanced search, and see how well not just different makes and models, but different body styles, tick your must-have boxes.

13: Locate and Test-Drive Cars

Test drives are not as routine as they once were. Local dealers may not let casual shoppers test drive a car if they only have a few of that model in inventory, and they know they’ll have another buyer who will put a deposit down unseen. National chain Carvana only allows a poor 20-minute, limited mileage test drive, although CarMax allows an extended 24-hour test drive—for certain vehicles, at their discretion. Fully virtual test drives for new cars will eventually overtake traditional test drives at local dealers, but we have a hard time thinking that will ever fully replace driving a car down the road.

Kick the TiresThe biggest complaints with new cars have nothing to do with the drivetrain. It’s frustrating infotainment and controls that make people crazy. See how hard it is to pair your phone, or how many menus you have to plow through to set a radio station. Does it have logical buttons and knobs, or do you have to look away from the road at a touchscreen to turn on the AC? Look at this machine-human interface separately from the actual test drive, because plenty of cars are good at one and not the other.

The Test Drive

Every new car performs well on a highway, so this is your chance to find out how it does everywhere else. A salesperson might recommend a route to try. Ignore them and go find potholes, onramps, and curves.

RideThe basic rules of ride and handling are: Short wheelbases are nimble but twitchy; long wheelbases smooth things out but can wallow; and the taller your vehicle is, the more likely it is to have nauseating head toss on uneven surfaces.

NoiseThis is where it’s important to get up to highway speeds. Lower priced cars, and SUVs and trucks with big grilles, tires and mirrors can get unpleasantly loud at higher speeds. If you’re planning on highway commuting, that might be a dealbreaker.

Power and AccelerationThere is always a tradeoff between power and efficiency, although hybrids and EVs go a long way towards evening that out. We think underpowered vehicles are dangerous in highway environments. You can’t get out of the way, pass, or merge safely. But if you’re mostly doing urban driving, then a small, efficient car that’s easy to maneuver and park, and which gets great mileage in stop and go traffic, makes more sense.

BrakingYou should only buy a new car with automatic emergency braking. Heavier vehicles, and vehicles equipped with off-road tires, have longer braking distances (and are less safe in general). Stomp on the brakes during your test drive, preferably on a loose or wet surface…but make sure you have enough room and won’t run into anything.

In used cars, insist on fresh brakes, and you can do a quick inspection. Brake rotors should be shiny, and if you stick your hand through the wheel and run your fingers over the rotor (making sure it’s not hot first!), it should be smooth and not have a raised lip at the edge. During your test drive, find an alley, underpass, or quiet narrow street between buildings. Brake with the windows rolled down so you can listen for any noises. EVs and some hybrids have regenerative braking that may make whining or gear sounds, but you shouldn’t hear any grinding or screeching. A little squeal is normal if a car hasn’t been driven for a while, but it should go away after a few stops.

HandlingSedans still offer the best balance of ride comfort and good handling. EVs, with a low center of gravity from heavy battery packs, can feel secure, but weigh hundreds of pounds more than traditional cars. One of the hidden costs of extra weight is tire wear, up to 20% worse in EVs, but heavy gas and diesel cars and trucks go through tires faster, too. The heavier and taller your vehicle is, the less margin for error you’ll have in emergency situations or bad road conditions.

14: Consider Your Buying Options

Already shaken up by the pandemic, the traditional dealer landscape is about to undergo another change, this time driven by the manufacturers. In addition to efforts like GM’s upcoming used car network, Ford’s CEO James Farley said his company would probably go “100% online…inventory goes directly to the customer, 100% remote pickup and delivery,” selling at a non-negotiable MSRP just like any other online retailer. A long-established local dealership with ties to the community is still a good option, especially if you have friends or family who have bought cars there. Reputation and repeat business is important when a dealer isn’t part of a big chain, and there are sometimes referral, loyalty, and other bonuses available.

Using the Dealer’s Website

A dealership will go to great lengths to collect your information, often hiding details until you enter your name and phone number. We can’t think of any good reason to fill out a contact form, because all that’s likely to do is get you a phone call from the newest salesperson working there.

We’ve seen more and more dealer sites listing cars that they don’t actually have, too. They may be “in transit” or “incoming,” but that could be weeks or months off. Some even list sold cars to make their inventories look bigger than they are. Dealer sites are often good for information on local promotional rates or other special offers, but read the fine print carefully.

If it’s available, look at pricing and markups, like the dreaded “market adjustment,” over the MSRP. "Current market conditions and very low vehicle inventories together with high consumer demand have impacted new vehicle pricing,” said Chris Naughton.

Visiting a Manufacturer’s Website

You should always spend some time on manufacturer sites, which are often a good way to compare features and specifications of different trim levels and different models, if you’re committed to one make. Actual on-the-ground inventory will often not reflect the full lineup for popular cars. At the time of writing, our local Chevrolet dealer had 16 new cars in stock, with eight out of Chevy’s 15 models sold out; and our nearest VW dealer had nine, covering four of VW’s ten models.

Connecting to Direct Buying Sites

Direct buying sites like Carmax and Carvana, while they have different models (CarMax has large dealerships, and Carvana is online-only), both connect you with a nationwide pool of cars. All of them are supposedly inspected and meet quality standards, but we’ve seen a lot of defects slip through the cracks. CarMax will ship in a vehicle from anywhere in the country for a substantial fee (often over $1,000), while Carvana has lower and variable shipping costs, based on distance from their nearest distribution center or vending machine. Both offer a completely online buying experience.

There are other direct buying startups as well, like Vroom and Driveway, each of which has pros and cons. CarMax is generally the best rated of the online retailers, but they all compete for inventory and it’s worth cross-shopping.

15: Addressing Problems After a Car Purchase

If you’re under warranty, bring your car in to the dealer service department as soon as something comes up. However, you can take it anywhere for repair or scheduled maintenance, and by law it won’t affect your warranty. If you purchased a used vehicle “AS/IS,” or from a private seller, you’re on your own no matter what, unless you can prove deliberate deception and decide to sue. All other sales from a dealership are covered by lemon laws, which vary state by state. Never wait to report a problem and ask for service, because unscrupulous service departments will find excuses to put off a repair until a warranty has expired. You can also be proactive and look for recalls and Technical Service Bulletins (TSBs), which may address your issue. Recalls will be paid for by the manufacturer, but TSBs may not be.

FAQs

After you’re done reading 25 years of reviews on AutoGuide.com, our section on researching vehicles and features (and, we suppose, our competitors), start talking to absolutely everybody. Find out not just what they drive now, but what their favorite cars have been, what their family drives, and what they do and don’t like about it. Ask for a ride. You’ll learn a lot sitting in the passenger seat. Then start visiting dealerships. You don’t need an appointment, just walk in and start opening doors.

What are the benefits of buying a used car?Buying a used car is a good way to avoid a dealership, and the markups they charge. If you’re a car person, or have a friend who’s a shadetree (or professional) mechanic, they may have information about cars that aren’t on the market, or know about overlooked options that are good values. If you have a car serviced at a local independent garage (and you should), they’re a great resource for finding cars, and for selling yours.

What should I do if I can't afford a car?It is harder than ever to afford a car now, and for many people, they’re just completely out of reach. If you’re really in trouble, reach out to organizations like the Good News Garage, 800charitycars.org, Vehicles for Change, and other regional charitable organizations that donate cars to people in need, or help with loans. We’re not aware of any national charities that have car donations, but please leave a comment if we’ve missed one.

How can I buy a car with bad credit?See How to improve your credit and get better loan rates and Organizations which can help with credit and debt management in Section 1 of this article for tips and links to explore to help get you a loan with bad credit.

After completing a degree project in automotive design, Dave wrote and photographed for almost a decade in print car magazines (remember those?), before transitioning to digital. He now subjects a series of old high-performance cars to the roads and weather in Vermont and wonders why they're always expensively broken. Please stop when you see him crawling under one on the side of the road.

More by David Traver Adolphus

Comments

Join the conversation

Same is true in selling your used car. I am a Wholsaler I buy cars in Nassau and Suffolk County, NY. There is so many people that need to be more educated on selling their cars as well as buying a car. I think your article was lengthy buy thorough. Most people do not have a clue as to where or how to buy or sell a car. An educated consumer is your best customer. Thank for the article.

I'm thankful you informed us that apart from when new models arrive in October or the end of the year, it's most preferable to buy a car during the last few days of the month, usually at the beginning of the work week and not the weekend. I'm thinking of buying a new Ford car soon, so I'm currently looking for an auto dealer to contact about it. I'll be sure to consider following what you said while I look for a new Ford Escape for sale soon.